Ever scratched your head over the monthly costs of vision insurance? You’re not alone. Like trying to find that elusive pair of perfect-fit glasses, figuring out the perfect vision for insurance can be tricky. No need to fret – we got you!

We all know eyes are windows to our soul, right? And it’s about time we started treating them with the same care as our homes’ glass panes – no scratches, smudges, or cracks allowed!

In this journey together, we’ll understand how much you should be shelling out each month for those peepers. We will explore everything from what factors affect your vision insurance monthly cost to what benefits these plans bring along, and we will even delve into some major providers in the game.

You’ll be filled with good news by the time you finish reading. That’s a promise!

Table of Contents

Understanding Vision Insurance Monthly Cost

Eye exams can be pricey, so how much does vision insurance cost? But how much does it actually cost to have vision insurance? It’s a good question, and the answer varies depending on several factors.

Diving into Vision Insurance Basics

Vision insurance coverage intends to aid in paying for ordinary eye tests and corrective eyewear like glasses or contacts. These plans often include coverage for preventive care, such as annual check-ups. The aim is to reduce out-of-pocket costs when caring for your eyesight.

Unraveling the Costs Associated with Vision Insurance

The monthly premiums for vision insurance can range from as low as $5 to over $30 per month. Now, you might wonder why there’s such a broad spectrum in pricing.

The truth lies in understanding what each plan covers: some may offer more comprehensive benefits, while others stick strictly to basic coverage.

This wide price range also accounts for different geographic locations where living costs vary substantially across states.

You should also consider this fact: an eye exam could set you back by around $531 on average nationally without any form of coverage. So, even at higher premium rates, investing in a solid plan could save money if regular visits are needed, or pricey prescriptions come into play.

Note:

Your choice ultimately depends upon individual needs and potential savings. Weighing these elements carefully will lead to making informed decisions about enrolling yourself under suitable vision plans offered by reputed companies nationwide.

Doing so ensures maintaining excellent eye health and efficiently manages expenses.

Exploring Coverage Details of Vision Insurance Plans

Vision insurance plans don’t offer a uniform solution. They come with various coverages, focusing on different aspects of eye care.

The Core: Preventive Care and Eyewear Allowance

The heart of most vision insurance plans is preventive coverage. This means routine eye exams to catch any potential issues early on. But what’s an exam without some prescription eyewear? Most plans include allowances for glasses or contact lenses each year.

Essentially, wearing glasses alone will help you see clearly while reducing your out-of-pocket costs for these essentials. Understanding vision benefits can really make this clear (pun intended.).

Coverage Beyond the Basics – What Else Can You Expect?

Beyond routine check-ups and specs allowance, many insurers offer additional perks as part of their packages. Some even provide discounts on LASIK surgery or a more generous frame allowance.

Your plan may also contribute towards the cost of specialist treatments if you suffer from certain conditions such as glaucoma or cataracts.

Navigating Through The Fine Print - Exclusions & Limitations

No matter how comprehensive it seems, every plan has limitations and exclusions that might affect your overall coverage.

- Contact lens fittings often have separate copays from regular exams,

- Premium frames might exceed your allowance,

- Cosmetic options like tinted lenses could be out-of-pocket expenses, too.

TIP: Don’t just focus on monthly premiums when choosing a policy. Consider all elements to get the best value.

Vision insurance options vary, so take time to understand what’s included in your plan. The small print is where it’s at.

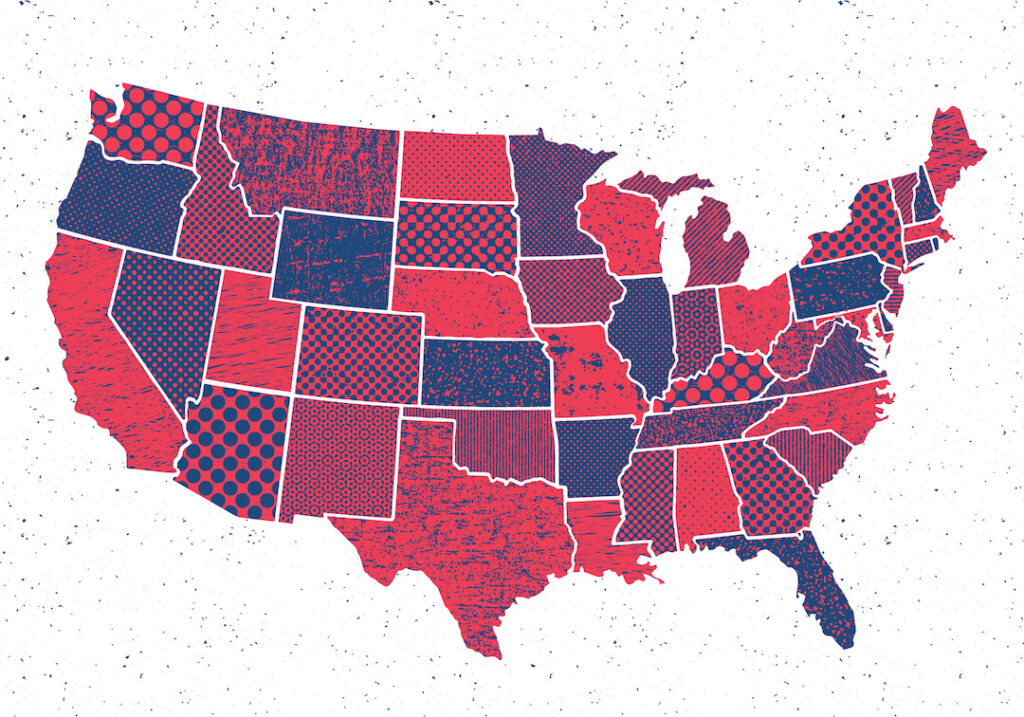

The Role of Geographic Location and Age in Vision Insurance Costs

Believe it or not, your area can significantly influence how much money is spent on vision insurance. For instance, those residing on the coasts might pay more than those in the Midwest. Why? It’s all tied to cost-of-living differences.

On top of that, your age is also factored into your monthly premiums. Typically, older individuals tend to have higher eye care needs due to conditions like presbyopia and cataracts.

This means they may need more frequent eye exams or specialized treatments, which are factored into their insurance costs. Hence, age can cause an uptick in rates.

Geographic Variations – A Closer Look

In areas with a high cost of living, like New York City or San Francisco, expect higher premium costs for vision plans than places like Omaha or Indianapolis, where life is less expensive. If interested, this guide takes a deeper dive into geographic variations.

Your Age - More Than Just A Number?

Your golden years come with some added perks, but lower insurance premiums usually aren’t one of them. That’s because as we get older, our eyesight tends to decline, making us more susceptible to various eye conditions. These potential risks factor into what insurers charge per month.

Understanding Vision Surgery Coverage

Vision insurance is often a puzzle regarding coverage for eye surgeries. While routine care like exams and eyewear gets the green light, elective procedures can differ.

Eye Surgeries Rarely Covered by Vision Insurance

You may wonder why vision insurance plans avoid covering LASIK or other laser eye surgeries. The key word here is “elective”. These types of treatments are usually thought to be elective since they’re not typically medically necessary.

If you’ve ever checked out the cost of LASIK surgery, you’ll know it’s no drop in the bucket. In fact, on average, Americans shell out around $4,400 for both eyes.

Exceptions to the Rule – When Does Vision Insurance Cover Eye Surgery?

The overall health picture isn’t entirely gloomy, though. There are instances where your vision plan might step up and cover costs related to certain laser eye surgeries – but only if deemed medically necessary.

An example could be an individual suffering from severe myopia (nearsightedness) or hypermetropia (farsightedness), which are vision problems that cannot be corrected using glasses or contact lenses. In such situations, laser surgery like PRK or even LASIK becomes less of a choice and more of a need.

Decoding Network Providers and Their Impact on Cost

Your choice of network providers can significantly impact the cost of your vision care. Choosing an in-network provider can save you money, as out-of-network providers may charge more for services.

In a nutshell, “in-network” refers to healthcare providers that have agreed to provide services at discounted rates for members of certain health insurance plans. This agreement benefits both parties – the provider gets a steady stream of patients from the insurer’s customer base, while the insurer can offer lower costs as a selling point for their plans.

Conversely, seeing an out-of-network doctor often results in higher out-of-pocket expenses because these doctors don’t have agreements with your insurance company. They might charge more than your plan considers “reasonable,” leaving you to cover the difference.

Navigating Your Insurance Network

Finding an eye care professional within your insurance plan’s network is easier than it sounds. Most vision insurance companies let you search online by zip code or city name so that you find local professionals who accept your coverage.

If staying with a particular doctor is important to you, but they aren’t part of any networks – consider switching insurers during open enrollment periods or ask about direct payment options where possible.

The Value Behind In-Network Services

Selecting an in-network provider helps save money on routine exams and eyewear purchases. It gives peace, knowing there won’t be surprise bills later on due to unexpected charges from non-participating practitioners. However, even though savings are real when using participating vendors, it’s still essential to check individual service prices since sometimes discounts vary between different practices within the same network. Don’t be reluctant to look for the greatest bargain.

Key Takeaway:

Choosing an in-network eye care provider can help you save on costs, as they offer services at discounted rates for members of specific insurance plans. However, prices may still vary between different practices within the same network. If your preferred doctor isn’t part of any networks, consider switching insurers or exploring direct payment options.

Weighing the Worth of Vision Insurance for You

Deciding to invest in a vision insurance plan can feel like a high-stakes game. However, understanding your unique vision care needs and potential savings can make this decision easier.

Personalizing Your Decision – Factors to Consider

Your choice should revolve around personal factors. These include the frequency of your eye exams, any ongoing eye conditions you might have, or even plans for laser vision correction surgeries in the future.

If annual eye exams and contact lenses are part of your routine life, an insurance plan could save you some bucks over time. On the other hand, if your eyesight is steady as a rock and visits to optometrists are rare occurrences, it might be worth reconsidering.

The Savings Potential with Vision Insurance Plans

Examining cost breakdowns could assist in understanding the amount of money that can be saved with vision insurance plans. With out-of-pocket costs soaring higher than Eagles – just think $531 on average per visit without coverage – having vision insurance worth a safety net doesn’t sound too shabby.

Most vision insurance plans offer allowances towards glasses or contacts, which could lead to substantial savings each year. Let’s not forget those sneaky little add-ons like anti-glare coating that can creep up on prescription sunglasses for unsuspecting folks.

Here’s an easy tool: our crystal ball into potential savings based on individual scenarios.

Remember, though: there’s no one-size-fits-all answer when weighing the worth of vision insurance because everyone has different needs (and eyeballs.). It’s all about finding what works best for you, your eyes, and your wallet.

By now, you should have a clear picture of the monthly cost of your vision insurance.

You’ve seen how age and location can affect premiums. We’ve highlighted the role of network providers in managing out-of-pocket expenses.

You learned that routine eye care and eyewear allowances are common benefits. Yet, elective surgeries like LASIK often aren’t covered by standard plans. And when they are, it’s usually for medical necessity.

We even dipped our toes into some big-name players in vision insurance like Humana and BlueCross BlueShield.

The final decision is personal, though. The potential savings on eye exams or glasses might make a plan worth it. But remember to weigh those against the monthly costs!