Ever wondered — “Does Vision Insurance Cover contacts? Linneo has the answers!

Does insurance cover contacts? This is a question that often leaves people who need contact lenses confused. Sure, your health insurance covers things like eye-related emergencies, but what about contact lenses?

Understanding the ins and outs of vision insurance can be tricky. Luckily, Linneo is here to demystify the ways that you can get coverage for your contact lenses. Don’t be overwhelmed—we’ll guide you through the process!

Vision coverage varies significantly from one plan to another. That’s why it is essential to know what is included in your policy before purchasing contact lenses. Whether you are new to wearing contacts or have been using them for years, understanding how insurance plays into your eye care expenses is essential.

If you’ve ever wondered, “Does insurance cover contacts?” keep reading! We’ll decode all aspects of vision coverage and provide valuable insights on maximizing your vision benefits here!

Getting Started: Does Insurance Cover Contacts?

Getting contact lenses for the first time requires several steps. Let’s discover which parts are usually covered

To answer the question “Does insurance cover contacts?” we need to start at the very beginning of the process—your initial contact lens consultation with eye doctor. A standard eye exam focuses on assessing overall eye health and determining if corrective eyewear is necessary. In contrast, a contact lens exam is more specific.

This specialized examination determines if you are a suitable candidate for wearing contacts and identifies the correct fit and prescription strength for your eyes. It is especially important for those who wear contacts or plan to start using them to have this consultation as it ensures optimal comfort and visual clarity.

Vision insurance plans vary in their coverage levels for these exams. Some may fully cover both types of exams, while others may partially cover the cost or not provide any coverage for vision exams at all. That’s why it is essential to learn about the available coverage alternatives before booking an optometrist appointment.

Glasses And Contacts: Can I Get Both?

You may wonder if glasses and contacts can be covered simultaneously by an insurance plan. This depends on the individual policies offered by different companies.

In many cases, vision insurance allows policyholders to choose either glasses or contact lenses during each benefit period—usually annually. However, some generous plans offer allowances for both forms of vision correction all within the same year.

If you like switching between glasses and contacts depending on situations such as work environments or social gatherings, finding a plan that offers simultaneous coverage could save you significant out-of-pocket costs over time. When you choose Linneo as your vision insurance provider, you are able to save on both glasses and contact lenses. Select plans include allowances for up to $250.00 that can be spent on either glasses or contact lenses.

Medically Necessary Contacts vs. Elective Contacts: Understanding the Difference

Whether your contact lenses are medically necessary or not could affect your insurance coverage

Though it might seem simple, getting contact lenses is not as straightforward as it may seem. In fact, there are two primary categories to consider when discussing contacts—medically necessary and elective. This distinction plays a significant role in determining your vision insurance coverage.

Contact Lens Prescription Essentials

A contact lens prescription involves more than just power measurements—it also includes specifications such as base curve and diameter due to the direct placement soft contacts on the eye.

If standard eyeglasses cannot adequately correct your vision due to certain conditions, an optometrist might prescribe medically required contact lenses with bifocal/multifocal correction methods.

Coverage Variations Based On Medical Necessity

Your vision insurance plans’ coverage often depends on whether they categorize contact lenses as being medically needed or an elective choice. It’s common practice among most health insurance companies to provide comprehensive coverage options for medical necessities—such as medically prescribed contact lenses.

Allowances for Contact Lenses

So, does insurance cover contacts? In some cases, it depends on your yearly allowance

If you wear contacts, the costs can add up quickly. However, many vision insurance plans offer yearly allowances that help offset these expenses.

The specifics of your contact lens allowance will depend on your particular plan and provider. Some might cover a fixed dollar amount each year towards contact lenses purchase, while others may pay a percentage of the cost.

Linneo vision insurance policies provide discounts for contact lenses and glasses that can be used as a gift card. Your total discount will depend on your plan type and the number of individuals covered. Linneo also offers an Eyewear Savings Plan, which helps members save 15% on eyewear and contacts courtesy of our network provider, Lensabl.

Tips to Maximize Your Insurance Plan Benefits

To get maximum value from your vision insurance when buying contact lenses, it’s essential to know exactly what is covered under your policy before making any purchases.

Your coverage details will be available in your policy documents. If you have additional questions about your coverage, it is highly recommended that you contact customer service at your insurance company. Having this knowledge beforehand helps avoid unexpected out-of-pocket expenses later on.

A smart strategy is to use all allotted benefits within one calendar year. Many policies do not roll over unused benefits into the next year—so make sure you’re using them completely.

Finding Additional Savings with Retail Promotions

In addition to maximizing the use of allowances offered by vision insurance plans, keep an eye out for promotions or sales provided by retailers. These opportunities could lead to further savings even as they stay within coverage limits.

With Linneo, you can “stack” discounts from our providers on top of your savings from your individual vision insurance benefits plan or your eyewear savings plan. For example, if one of our online network partners is offering a sale, you can apply your additional discount from Linneo on top of our network provider’s discount!

The Cost: Contacts With and Without Insurance

If you don’t have insurance, expect to pay high out-of-pocket costs

Decoding the cost of contact lenses—both with insurance coverage and without—is important for making informed decisions about your eye care. Prices can vary greatly based on factors such as brand, prescription strength, type of lens, or whether you opt for disposable or extended-wear contacts.

Prescription Glasses vs. Prescription Sunglasses vs. Contacts

A comparative analysis of the costs of prescription glasses, sunglasses with prescriptions, and contacts provides some noteworthy insights. Initially, it may seem that a basic pair of eyeglasses could be less expensive than an equivalent set of contact lenses.

However, this is not always necessarily the case. Depending on the type of prescription lenses you require for eyeglasses or the type of contacts you need, you may find that contact lenses are a less expensive option. You can also check your coverage to see which option fits best with your coverage.

Sunglasses fitted with prescriptions are often seen as an extra expenditure by many insurance companies and vision plans. Therefore, their purchase might not fall under regular vision plan benefits unless they’re medically necessary due to conditions like photophobia (light sensitivity).

Out-of-Pocket Costs

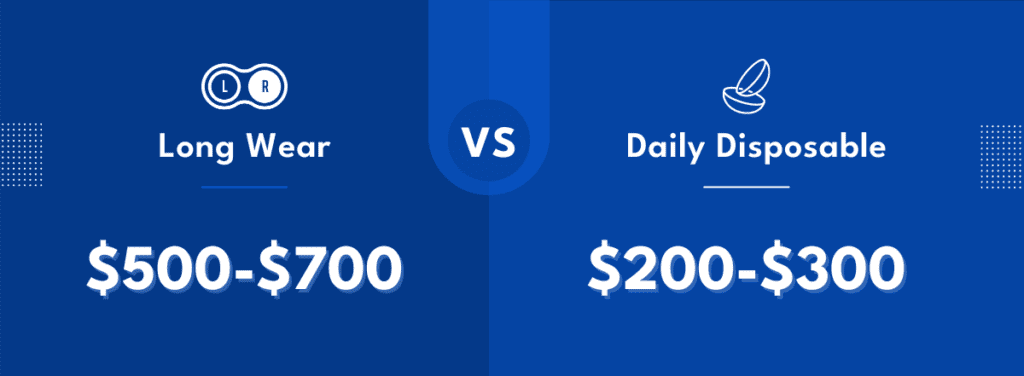

If you lack sufficient vision insurance coverage options for purchasing contact lenses, out-of-pocket purchases can become costly. An average annual supply pack containing daily disposables ranges from $500-$700, whereas monthly disposables hover around $200-$300.

This does not include additional expenditures associated with maintaining these—including storage cases, cleaning solutions, and other accessories. Also, keep in mind that all potential contact lens wearers need valid eye exams & prescriptions specifically designed to fit them, which is an additional cost. With vision insurance coverage from Linneo, you can get discounts on both your contact lens exam and your contact lens purchases.

Exploring Eye-Care Coverage Options

There are several ways that you can get insurance coverage for contacts—let’s take a look!

Navigating the world of vision insurance can be daunting. However, it is more approachable when you have a clear understanding of your coverage options. Most vision insurance plans cover part or all costs related to glasses or contact lenses, as well as comprehensive eye exams.

Medicare And Vision Insurance

Medicare is the federal health insurance program primarily designed for individuals aged 65 and older. This type of coverage typically does not provide coverage for routine vision care, such as eyeglasses or contact lenses. However, certain medical conditions affecting eyesight may qualify you for some degree of Medicare-provided coverage.

An annual exam testing diabetic retinopathy in diabetes patients falls under this category covered by Medicare Part B. Similarly comprehensive eye exam, tests and treatments associated with macular degeneration are also included. If cataract surgery becomes necessary due to a deteriorating eye health condition, one pair of prescription eyeglasses or one set of contact lenses is provided after each cataract surgery. Additionally, an implanted lens could be partially covered by Medicare Part B.

Eyewear Savings Plan vs. Individual Vision Insurance

If you do not require all of the coverage associated with a vision insurance policy, an eyewear savings plan may be a viable alternative. This type of membership program offers discounts on various services, including prescription glasses, sunglasses, and accessories.

They’re often less expensive than standard premiums that come attached to typical vision insurance yet require more out-of-pocket expenses when making purchases. A vision discount plan is beneficial for anyone who requires discounts on eyeglasses or sunglasses but does not require discounts on additional eyecare.

Does Insurance Cover Contacts? Frequently Asked Questions

Does insurance cover contact lenses?

Yes, many vision insurance plans do provide coverage for contact lenses. However, the extent of coverage varies based on individual policies and whether contacts are medically necessary or elective.

How does insurance work for contact lenses?

Vision insurance typically covers a portion of the costs associated with eye exams and prescription eyewear, including contact lenses. Some plans may offer yearly allowances towards standard contacts.

How much do contacts cost after insurance?

The out-of-pocket expense for contacts can vary widely depending on your specific health plan’s benefits and the type of lens prescribed. Costs could range from minimal to several hundred dollars annually.

Can you get both glasses and contacts with insurance?

In most cases, vision insurance allows you to use your vision insurance benefits either for glasses or contact lenses but not both in the same benefit period. Policies differ, so it’s best to check specifics with your provider.

Understanding vision insurance and its coverage for contact lenses is key to maintaining eye health. When it comes to getting contact lenses with insurance, there are a few things you need to keep in mind. For example, it is important to know that contact lens exams are distinct from regular eye exams, and both are crucial for those who wear contacts. It is also very important to keep in mind that there is a distinction in coverage between medically required contacts and elective ones—the former will receive more comprehensive coverage.

And there you have it, the answer to “Does insurance cover contacts!” While it isn’t as straightforward as many imagine, there are lots of coverage options out there that will save you money on your contact lens exams and purchases.

If this feels overwhelming, don’t worry! Linneo offers a range of individual vision insurance options and an eyewear-saving plan! Explore your coverage options and discover how much you can save today!