If you’re wondering—“How does vision insurance work?” Linneo has you covered!

Many people are aware of vision insurance but aren’t sure of exactly how it works. In order to answer the question— “How does vision insurance work?”—we need to explore different types of insurance policies—plus their advantages and disadvantages—to help you better choose the right type of coverage that fits your needs.

In this article, we’ll be going over the difference between vision insurance and health insurance. Then, we’ll explore some of the ways that Linneo can provide you and your family with easily accessible vision coverage at a low cost. Ready to get all of the facts about vision insurance? Keep reading!

Why is Vision Insurance Important?

Before we get into how vision insurance works, let’s explore why it is so important for individuals and families

Vision insurance is important for getting affordable and accessible eye care for yourself and your family members. A lot of eyewear and eyecare is prohibitively expensive without the right coverage. That’s why it is so important to get all of the facts before you make a decision for vision coverage.

With access to vision coverage, you will get discounts or allowances for eyewear and for some eyecare services—like prescription renewal. Without insurance coverage, many people are more likely to skip out on these types of services. This is fine until you run out of contacts or break your glasses. In those cases, you are stuck in a tough spot if you are uninsured.

In this type of situation, you will likely end up paying a high cost out of pocket and scheduling last-minute appointments to restore your vision. Vision insurance can help cover costs in critical situations like these, so you aren’t breaking the bank for replacement eyeglasses or a new shipment of contact lenses.

Now that we know why vision insurance is so important, let’s go over some of the key differences between vision insurance and health insurance.

Is Vision Insurance Different From Health Insurance?

Now that we know why vision insurance is important, let’s find some answers to the question—“How does vision insurance work?”

What’s the deal with vision insurance? You might be surprised to learn that it’s simpler than you think.

In essence, vision insurance is a type of health benefit specifically designed for your eyes. However, it isn’t quite that simple. Let’s take a look at some of the key differences between vision insurance and health insurance.

Vision Insurance vs. Health Insurance

Many people who are getting vision insurance for the first time may confuse the coverage with health insurance coverage. So, what is the difference between this and regular health insurance? It’s all in the details. Let’s take a look.

Your typical health plan covers general medical expenses like doctor visits or hospital stays. Still, it often overlooks comprehensive eye care services such as annual eye exams or prescription eyewear—services that are essential for maintaining good vision and overall well-being.

This is where specialized coverage comes into play. Vision insurance bridges gaps left by traditional healthcare plans while providing discounts on critical items such as glasses or contact lenses. It has been reported that more than 2 billion people worldwide need corrective lenses due to various forms of visual impairment. That’s a lot of people out there that can use a vision insurance plan.

If you’re considering investing in one of these policies, remember that not all vision insurance plans are created equal. Some offer allowances towards frames and contacts, while others may cover the full cost depending upon specific terms outlined within individual contracts. In order to get the best possible coverage for yourself and your family, always read through the fine print before signing up.

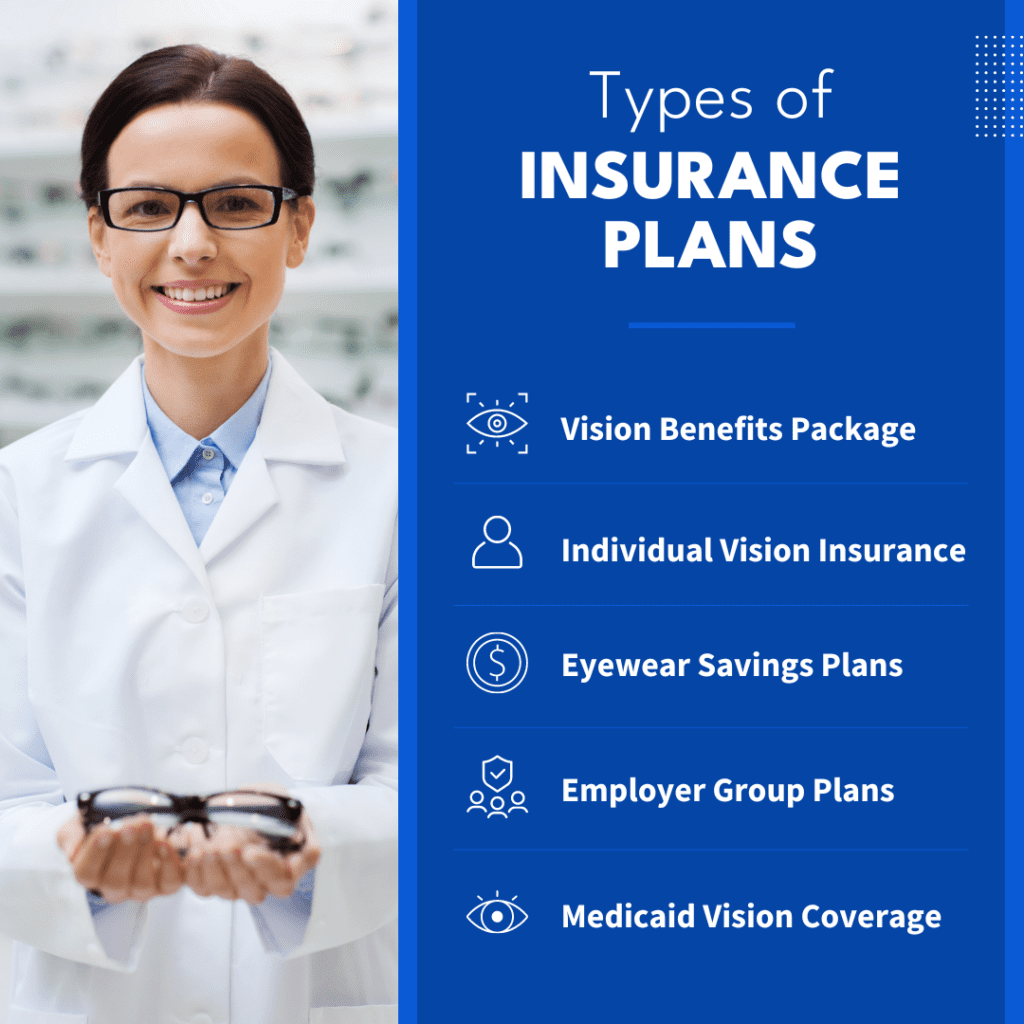

Types of Vision Insurance Plans

If you’re not sure how vision insurance works, then it is easy to get overwhelmed by the number of plans

Each type of vision insurance plan is designed to meet different needs and budgets. That’s why it is important to get the facts before you make your final decision. Let’s take a look at the different types of business plans so that you can choose the one that works the best for you and your family members.

- Vision Benefits Package – This type of vision insurance is usually offered as part of an employer-sponsored health benefits package. It provides coverage for routine eye care, including eye exams, eyeglasses, and contact lenses. Sometimes, there may be a copayment for certain services.

- Individual Vision Insurance – This type of insurance is purchased independently and is not tied to any specific health insurance plan. It typically covers routine eye exams, eyeglasses, and contact lenses and may provide discounts on other services like prescription renewal.

- Eyewear Savings Plans – These plans are not technically insurance but rather discount programs. They offer reduced rates on vision-related services when you visit participating providers. Instead of paying for insurance premiums, you pay an annual or monthly membership fee to access discounted services and products.

- Employer Group Plans – Many employers provide group vision insurance plans to their employees. These plans may offer coverage for eye exams, eyeglasses, contact lenses, and other vision-related services.

- Medicaid Vision Coverage – Medicaid is a government program that provides health insurance to eligible low-income individuals and families. While Medicaid coverage varies by state, it typically includes vision benefits for children, including eye exams and eyeglasses. Coverage for adults may be limited and vary from state to state.

With all of these options, choosing the right one can quickly become overwhelming. Before you make your final decision, you need to have a good grasp on the different services and purchases vision insurance covers.

What Does Vision Insurance Cover?

There is still more to explore to fully answer the question—“How does vision insurance work?” Let’s take a look

Vision insurance is a vital tool for maintaining good vision. But what exactly does it cover? Each coverage option provides slightly different options for eyewear and eye care. To get started, let’s take a look at the most common offerings from vision insurance plans.

Eyewear and Exams

The core of most vision insurance plans includes coverage for annual eye exams, prescription eyeglasses, and contact lenses.

Premium Lenses And Frames

If you’re someone who likes to express their style through glasses or needs specific lens enhancements like progressives or photochromics, don’t worry. Your vision plan may offer an allowance towards these items too.

Contact Lens Evaluation & Fitting

Apart from the cost of contacts themselves, your plan might also include fitting fees, which are crucial if you’re new to wearing them or switching brands/types. Remember, while all this sounds great on paper – only some policies offer the same level of benefits. That’s why it is so essential to read up on what your particular policy covers before scheduling regular eye exams.

How to Buy Glasses with Vision Insurance

Navigating the cost of eyewear can be intimidating, but vision insurance benefits make it easier

To get started, identify an eye doctor within your network who accepts your plan. This ensures you maximize the value of your monthly premium payments. When you choose Linneo for vision insurance coverage, you don’t need to worry about staying within a network. Our network is wherever you are. Simply choose the provider you feel the most comfortable with or a provider that is the most convenient for your location.

Once you have your provider selected, you will need to undergo an eye exam or a prescription renewal. During the eye exam, your vision will be tested—which determines your prescription. There are also remote prescription renewal services available for people who don’t have the time to visit an optometrist in person.

Now that you have your prescription, it is time to select your new pair of eyeglasses or contact lenses. The amount you can spend on eyewear will be determined by your insurer and the type of policy you choose. Most vision insurance plans provide a range of options that cater to different tastes and budgets.

However, if you want designer glasses or those outside what’s included in your coverage limit – don’t fret. You only pay the difference between their retail price and what’s allocated by your insurance. That way, you can get the great prescription specs you want without having to spend a lot out of pocket.

How Linneo Works

Searching for ways to get covered or supplement your existing coverage? Look no further than Linneo!

If you’re searching for a vision insurance policy that offers top-notch vision protection tailored to meet individual requirements, Linneo is the perfect choice. Our innovative platform revolutionizes the way you access and manage your eye care.

One standout feature is its easy online access to services. No more waiting in an office! With just a few clicks, you can get your prescription renewed and order eyewear or contact lenses right from your home.

Beyond convenience, affordability is another key advantage of choosing Linneo. Our monthly premiums are competitively priced without compromising on quality or scope of coverage. This makes Linneo an ideal choice for single parents and service workers who might not have employer-provided health benefits.

Linneo offers vision insurance plans and an eyewear savings plan, so you can choose which coverage option will work best for you and your family. Discover how much you can save with Linneo today!

How Does Vision Insurance Work? And Other Frequently Asked Questions

Why is vision insurance so important?

Vision insurance promotes eye health by making regular exams, prescription eyewear, and contacts more affordable.

What is the meaning of vision insurance?

Vision insurance is a supplemental health plan that reduces the cost of eye care services and products like exams, prescription eyewear, and contacts.

What is the difference between a vision plan and vision insurance?

A vision plan provides pre-paid eye care benefits, while vision insurance covers part of the costs for services after deductibles or co-pays are met.

Vision insurance works by making eye care and eyewear affordable. Depending on your individual needs, you make explore a variety of different plans. If you are in need of individual vision insurance or a vision discount plan, explore the convenient options provided by Linneo.

Remember—not everything falls under coverage. Certain procedures may be excluded. Knowing what these are helps you plan better financially. Making the most out of your vision plan means utilizing preventive measures like regular eye exams, which can detect signs of serious illnesses such as diabetes at their earliest stages.

At Linneo, we believe everyone deserves access to quality vision care without breaking the bank. Our mission is simple—provide comprehensive coverage tailored specifically towards each individual’s unique needs. Our online retailers make getting access to eyewear and eyecare easier than ever! Ready to take control of your eye care? Find out how much you can save with Linneo today!